Economic crisis needs methods to conserve the currency that you have and one of it is an investment decision in rare earth metals. Economic crisis will always be there along with growth but just recently there aredependable organizations that are beginning to crash. One of those assets that can be traded are the REE. Rare metals along with gold and silver are tangible resources that can be stored in secured holding establishments with a legal title that a purchaser can acquire. The financial market activity doesn't affect the value of rare earth trading. Which means they are not relying on the market activity.

Source: www.raremetalblog.com news story

In any manufacturing of components made of metal, these metals are the important components unfamiliar to many people. Later release of the products and the more recent production are just in line waiting for official launching in the market. That’s how very fast the manufacturing of high technology products nowadays.

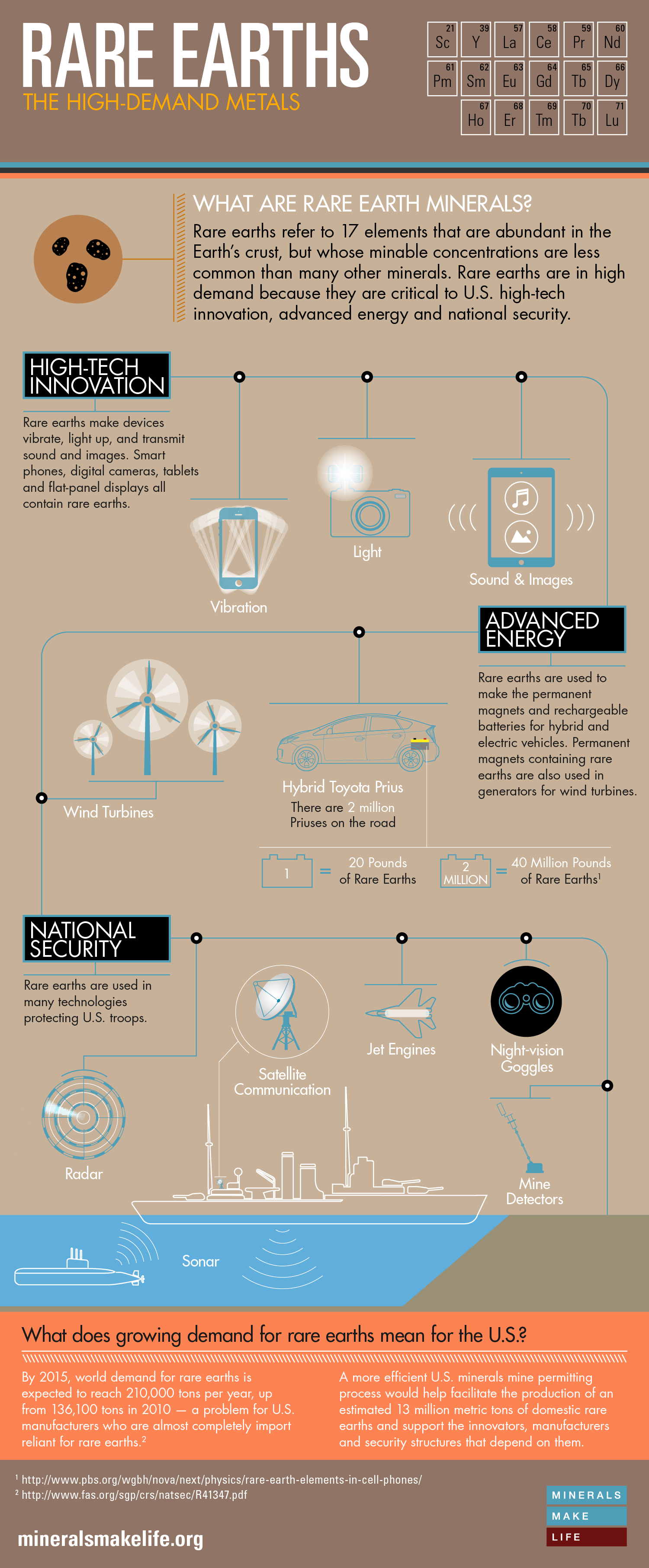

Rare earth metals are used in today’s personal gadgets such as computer, tablets, or mobile phones, hence raising the demands. Your vehicle, medicine, clothing, opticals, as you may not know, possess rare earth metals in them. Among these manufactured items, 80% of them have rare earth metals and because of the rapid manufacturing, the demand for them has grown too. As several years have passed, the significance of these metals are continually on the rise mainly because of the raising needs.

Rare earth metals obtainable in the market are and not restricted to Cobalt, Chromium, Molybdenum, Tantalum, Deselenide, Gallium, Indium, Copper, Zirconium, Tungsten, Bismuth, Tellurium and Hafinium. You may put some combination of these metals that are required by industry sectors. The need may be high and you can benefit from it. In this instance, carefully investing in metals like Copper, Gallium, Indium, and Diselenide would put heavy value to your portfolio among the companies of PV thin-film solar cells. Metals like Tellurium, Indium, Hafnium, Gallium, Tantalum, and Bismuth can be strategically packaged too as general purpose investment because a number of industries need them.

China is currently monopolizing rare earth metals and this helps make the need of REE continually growing. Trader or investor of these metals would benefit due to its high demands among rapid development of fast advancing countries.

Rare earth metals are the key prerequisites needed by industrial countries like Korea, USA, Germany, and Japan in making high-end products. It will require time for new mining operations to start up and help the world supply of rare metals and it is not likely these new efforts will be able to satisfy exponentially amplified demand. This will get your metal resources more worthwhile and afloat.

Rare earth metal brokers are respectable individuals who know how to handle your metal resources. This consists of investing and holding your metal resources. Basic fundamentals of demand and supply determine the pricing of rare metals. These are not impacted by financial markets, hence making this financial commitment good and advantageous.

Economic crisis calls for methods to keep the currency that you have and one of it is an investment in rare earth metals. Economic crisis will always be there along with development but just recently there aredependable companies that are beginning to crash. One of those assets that can be traded are the REE. Assets that are tangible just like silver and gold along with rare metals can have a legal title that a buyer can acquire and can be kept in a facility. In any market activity, the importance of rare earth trading is not impacted just like financial market developments.

In any sector where metal components are needed, these are produced using these metals as among the components concealed to the people. Later version of the items and the more recent development are just in line waiting for official releasing in the market. That’s how insanely fast the production of high technology products nowadays.

Rare earth metals are used in today’s private devices such as laptop or computer, tablets, or cell phones, hence raising the demands. You may possibly not know it but your house appliances such as flat screen TV, or your car, clothing, and medicine possess rare earth metals in them. Around 80% of all manufactured products consist of rare earth metals and the pace of development of new technological innovation implies the demand for these metals from industry surpasses actual industry production. As the demand grows every year, there is no doubt that the intrinsic value of these metals would increase too.

Rare earth metals out there on the market are but not restricted to Cobalt, Chromium, Molybdenum, Tantalum, Deselenide, Gallium, Indium, Copper, Zirconium, Tungsten, Bismuth, Tellurium and Hafinium. You may put some mixture of these metals that are wanted by industry groups. The need may be substantial and you can make the most of it. For instance, investing smartly in Copper, Indium, Gallium, and Diselenide would mean your portfolio would be of importance for the production of PV thin-film solar cells. Metals like Tellurium, Indium, Hafnium, Gallium, Tantalum, and Bismuth can be smartly packed too as general purpose investment because a number of industrial sectors need them.

These REE are increasing continuously in value because of the extreme supply and demand situation created by China's monopoly of rare earth metals. The rapid growth of developing countries where rare metals are in significant need, benefit the investor and trader in this market.

USA, Germany, Japan, and Korea are all industrial nations that are in continuous need to have of rare metals in their production of very advanced goods. More time will be required for newly operational mining companies to begin providing these rare metals. It would be a challenge to instantly impact in contributing the fast-growing needs around the world. What this (*) means is your metal assets will increase in price and stay buoyant.

Rare earth metal brokers are respected individuals who understand how to manage your metal assets. This consists of investing and holding your metal assets. Rare metal’s price relies on the free market of demand and supply. It’s not subjective to the speculative trading, thus making it a valuable investment because it is not affected by the typical financial markets.